Objective The objective of this Public Ruling PR is to explain the tax treatment for businesses in Malaysia in respect of foreign exchange gains and losses which arise from cross border transactions denominated in foreign currency. Tax Leader PwC Malaysia 60 3 2173 1469.

Capital Gains Tax In Malaysia Things You Need To Know

Tourist Arrivals in Malaysia increased to 971574 in June from 670474 in May of 2022.

. Since inception in 2018 with a team of just 5 Hoxton Capital has grown to over 100 employees across 8 global offices. 13 December 2019 _____ Page 1 of 13 1. INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Capital gains tax CGT rates. The proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each year regardless of whether. However capital gains derived by a company will generally be taxed as dividends on distribution to shareholders subject to certain exceptions.

Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well as other sectors such as those involved in Islamic financial services ICT education tourism healthcare as well as research and development. Inheritance and gift tax rates. A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchaseSo if you sell a property for more than you paid for it thats a capital gain.

Melayu Malay 简体中文 Chinese Simplified Tax Incentives in Malaysia. Capital Gains Tax Exemptions or Discounts. Main residence exemption allows homeowners to avoid paying capital gains tax if their property is their principal place of residence PPOR.

It forms part of your income tax and is payable to the Federal Government. Long-term capital gains from the investment made for a period of more than 36 months and short-term capital gains from the investments made for not more than 36 months. Long term Capital Gains.

I never did so. New Zealand does not have a comprehensive capital gains tax. This page provides - Malaysia Tourist Arrivals - actual values historical data forecast chart statistics economic.

Short term Capital Gains. The first one is main residence exemption. This post is also available in.

Nigeria Last reviewed 28 July. Several years ago I set up a CommSec account with Commonwealth Bank Australia for the purpose of buying shares. Nicaragua Last reviewed 01 July 2022 15.

New Zealand does not have a comprehensive capital gains tax. Featured PwC Malaysia publications. Tourist Arrivals in Malaysia averaged 154374834 from 1999 until 2022 reaching an all time high of 2806565 in December of 2013 and a record low of 5411 in May of 2020.

Net wealthworth tax rates. Hoxton Capital Management has quickly established itself as one of the fastest growing independent advisory companies. I work in Malaysia.

Capital gains tax does not apply to assets unless they taxable Australian property which most shares will not be. Tax and Duty Manual Part 35-01-05 5 2 Certification of Tax Residence for Funds in accordance with Sections 731 738 and 739B of the Taxes Consolidation Act 1997. Capital gains tax is the tax you pay on any capital gain profit you make from the sale of certain assets including investment properties.

What is capital gains tax. I am an Australian citizen but non-resident for tax purposes. There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

Capital gains tax CGT for those who are new to this is the levy you pay on the capital gain made from the sale of that asset. The tax that is applicable for each of these is also different since short-term gains tax is computed basis the income bracket. There are several ways in which you can avoid capital gains tax.

Print corporate tax summary.

Capital Gains Tax In Malaysia Things You Need To Know

The Average Household Income In America Financial Samurai

.jpg)

Financing And Leases Tax Treatment Acca Global

Taxation On Property Gain 2021 In Malaysia

Crypto Tax Free Countries 2022 Koinly

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

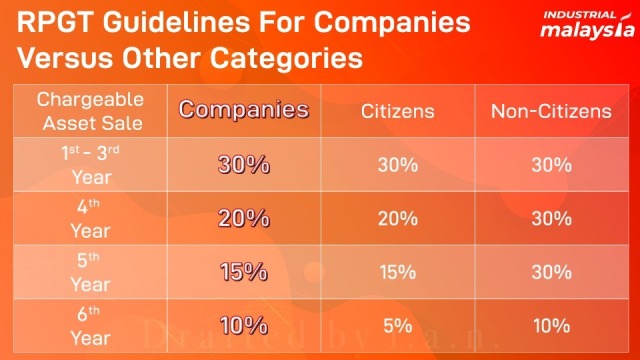

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Capital Gains Tax In Malaysia Things You Need To Know

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Part 1 Acca Global

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

9 Expat Friendly Countries With No Capital Gains Taxes

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Taxation Of Dividend Income And Capital Gains

Real Property Gains Tax Part 1 Acca Global

The Best Capital Gains Free Countries For Forex Trading Business Review

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important